If you are interested to apply for a PNB account (savings, checking, time deposit, investments, etc.) with PNB, here are the guidelines and some tips you can follow.

1. Prepare beforehand the needed requirements in opening an account in PNB.

Philippine National Bank (PNB) Requirements in Opening an Account:2. Have a personal appearance in any Philippine National Bank (PNB) branch.

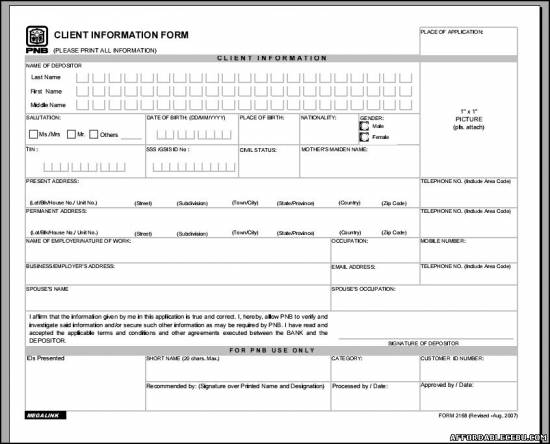

- Duly Accomplished Client Application (CI) Form, Account Information (AI) Form and Signature Card. These are available in any PNB branches.

- As per Bangko Sentral ng Pilipinas (BSP) Monetary Board Resolution No. 553 dated May 8, 2008 released under BSP Cir. No. 608 series of 2008 and PNB Gen. Cir. 3-1498/2008 Clients who engage in a financial transaction with the Bank for the first time shall be required to present the original and submit a clear copy of at least ONE (1) valid photo-bearing identification document issued by an official authority. "Official Authority" in BSP term, shall refer to the following:

- Government of the Republic of the Philippines;

- Its political subdivisions and instrumentalities;

- Government-owned and/or controlled corporations (GOCCs);

- Private entities or institutions registered with or supervised or regulated either by the Bangko Sentral ng Pilipinas

- (BSP) or Securities and Exchange Commission (SEC) or Insurance Commission (IC)

- Bring at least two (2) of the following valid id:

- Passport

- Driver's License

- Professional Regulation Commission (PRC) ID

- National Bureau of Investigation (NBI) Clearance

- Police Clearance

- Postal ID

- Voter's ID

- Barangay Clearance

- Government Service Insurance System (GSIS) e-card

- Social Security System (SSS) Card

- Senior Citizen Card

- Overseas Workers Welfare Administration (OWWA) ID

- OFW ID

- Seaman's Book

- Alien Certification of Registration/Immigrant Certification of Registration

- Government Office and GOCC ID, e.g., Armed Forces of the Philippine (AFP ID), Home Development Mutual Fund (HDMF ID)

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

- Integrated Bar of the Philippines

- Company IDs issued by private entities or institutions registered with or supervised or regulated either by the BSP, SEC or IC.

3. Determine what type of account you want to open. And know the corresponding form of the type of bank account to fill up or accomplish.

Types of Accounts:

4. All new applicants/depositors shall be required to accomplished one copy of Client Information (CI) form.Name Forms to Accomplished:

- Individual Depositor Account

- Joint Depositor Account

- Business/Corporate Account

- Client Information Form (CIF) - to be accomplished by the Individual/Joint Depositors and each administrators/authorized signatory of corporate accounts

- Business Information Form (BIF) - to be accomplished by Business/Corporate accounts only.

- Account Information Form (AIF) - to be accomplished by Individual/Joint/Corporate depositors

5. Existing depositors shall not be required to accomplish another/new CI form. A depositor may open several accounts but shall be required to accomplish the CI form only once.

6. For Joint Accounts, each depositor/co-depositor shall accomplish a separate CI form. However, if any of the co-depositors is an existing depositor of the Bank, the provision stated under step no. 4 shall apply.

7. For Business/Corporate Accounts, each designated administrator (i.e., officer/individual appointed and authorized by the company/corporation as representative) of the account shall accomplish a separate CI Form. However, if any of the administrators is an existing depositor of the Bank, the provision stated under step no. 4 shall apply.

8. No CI form shall be filled out under the name of the business or corporation.

9. If there are fields not applicable/available to the client/depositor (e.g., telephone no., name of employer, spouse's name etc.) and no information are provided, "N/A" shall be indicated on the field. (note: N/A means Not Applicable).

10. Business Information (BI) form shall be used exclusively for Business/Corporate Accounts only. Any of the designated administrators shall be required to duly accomplish one (1) copy of the form.

11. Existing business/corporate accounts may open several accounts but shall not be required to accomplish another/new BI form, even if the company/corporation is an existing depositor of another PNB branch, provided that the names of designated administrators (i.e., officer/individual appointed and authorized by the company/corporation as representative) for the new account being opened are the same.

12. Account Information (AI) form shall be used for any type of deposits (e.g. savings, checking, term) and type of accounts (e.g., individual, joint, business/corporate).

13. It shall be filled out for every deposit account opened by the depositor. In case of joint account, inform the branch of the primary owner of the account and have it written on the appropriate portion of the form.

14. For Overseas Offices, the following are valid/acceptable identification documents provided these are issued by government authorities/agencies in their respective host country and are bearing the photograph and complete address of the client:

| PNB New York State Issued Drivers License State Issued Identification Card Passport (US or Philippine issued) Resident Alien Card Social Security Card | PNB Los Angeles State Issued Drivers License State Issued Identification Card Passport (US or Philippine issued) US Military Identification Card |

| PNB RCC Canada State Issued Drivers License Permanent Resident Card Passport (Canada or Phil issued) Social Security Card | PNB Honolulu Hawaii US Issued Drivers License US Permanent Resident Card US Passport Hawaii State ID US Social Security Card |

| PNB Guam Guam issued Drivers License US Permanent Resident Card US Passport Government of Guam ID US Military Identification Card | PNB Tokyo/Nagoya Philippine Passport with unexpired Japan Visa/Alien Card |

| PNB Hong Kong Hong Kong ID | PNB Singapore Singapore Employment Pass Singapore Work Permit Singapore Dependent Pass Singapore Identity Card Singapore Company Issued ID |

| PNB Europe PLC, (London) Correctly Certified Passport (Philippine or UK with Proof of existing address) | PNB Italy SPA, Rome/Milan Passport (Philippine Or Italian Issued) Permesso Di Soggiorno (Permit to Stay) Carta D'Identita (Italy ID Card) Codice Fiscale (Individual Taxpaye Number) |

| PNB Madrid/Florence Spanish Residence and Working Permit Spanish National Identification Card | PNB Hamburg Passport (Philippine Or German Issued European Union Identity Card Philippine Embassy Identity Card European Union Driver's License |

| PNB Vienna Passport (Philippine Or Austrian Issued) Austrian Identity Card Austrian Driver's License | PNB Netherlands Passport (Dutch or Philippine Issued) Dutch Residence Permit (MVV) Dutch Driver's License European Identity Card Dutch Identity Card |

| PNB Dubai (UAE) Labor Card Health Card Driverís License Company/Employment ID Card | PNB Riyadh (Saudi Arabia) IQAMA (National ID) PNB Riyadh (Kuwait) Civil ID Health Card Driver's License Company/Employment ID |

15. STUDENTS who are beneficiaries of remittances/fund transfers who are not yet of voting age may be allowed to present the original and submit a clear copy of ONE (1) valid photo-bearing school ID duly signed by the principal or head of the school where the student is currently enrolled.

16. For Non-resident alien they are required to submit Alien Certificate of Registration (ACR)/Immigrant Certificate of Registration (ICR).

17. Since the Bank already requires a clear photocopy of the photo bearing ID presented, branches shall no longer require pictures from clients as attachment to the Signature Card. However, clients shall be required to submit an updated picture or present the original and submit a clear copy of the photo-bearing ID every two (2) years.

18. Additional ID picture maybe required for the attachment to the CI form and for the scanned copy of picture uploaded in the flexcube if ever the photo bearing ID is not feasible for scanning.

19. Eligible to open an account at PNB (GEN. Cir. 3-1441/2007)

Savings:Checking:

- Individual / Joint Account

- Citizen and Resident Alien

- Person at least 12 years old

- Below 12 years old ITF by parent, legal guardian, trustee, administrator

- Non-Resident Alien

- FX Currency Deposit

Time Deposit:

- Peso and Greencheck (Dollar)

- Citizen and Resident Alien

- Person of legal age (at least 18 years old)

- Non-Resident Alien

- Individual / Joint Peso Checking Account

- Requirements (As applicable):

- For walk-in applicants:

- Maintenance of savings account for at least six (6) months before he/she can open a checking account.

- For Business Accounts:

- Simple credit investigation is required to ensure legitimacy and existence of Business

- For applicants endorsed / referred by Bank Officer:

- No credit investigation shall be required but the name and signature of the Officer must be indicated in the CI form and Signature Card.

- Peso and FX Currency

- Individual / Joint Account

- Citizen and Resident Alien

- Person of legal age (at least 18 years old)

- Below 18 years old IT by a parent, legal guardian, trustee, administrator

- Non-Resident Alien

- FX Currency Deposit

- https://www.affordablecebu.com/