You will learn here how your money transfers in a banking process and how the bank earns money in the process.

If you’re a newbie of some financial terms discussed here, don’t worry. I provided easy-to-understand definitions and examples of them.

If you’re a newbie of some financial terms discussed here, don’t worry. I provided easy-to-understand definitions and examples of them.

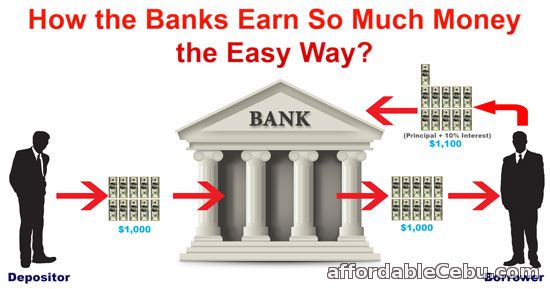

An illustration of a simple process on how banks earn money

Let’s discuss first how banking works. Here’s a depositor (think that you’re the depositor), a person who deposits his money in the bank mainly for security reasons. And then you deposit your money to the bank. And the bank receives your money and keeps it in their highly secured vault. But the question is how can they earn money from the money they kept? Here are the ways banks earn money. Many of them you might not even know.

1.) Banks earn money mainly from interest rates.

The money that you’ve deposited to the bank will be lent to another person, organization, or corporation. The process of lending money that charges interest rate is called loan. Banks will charge interest rates from the loans of those borrowers. You may ask, "What is interest rate?” Interest rate is the percentage fee or percentage of money that the borrower lends from the bank. For example, if a person lends 1,000 dollars from the bank at an interest rate of ten percent (10%). 10% of 1,000 dollars is 100 dollars. 100 dollars is the profit that the bank earns. What will happen to the 1,000 dollars that the person lends? It will be given back to the bank together with the 60 dollars interest charge. Typically, the borrowed money is paid back to the bank in regular installment, usually per month for small loans. The amount of interest rates that banks charge depends on some factors. If a trend appears that lesser number of people borrow money in the banks, the banks will lower their interest rates in order to convince the people to loan money from them. The more people loan money from the bank, the more money the bank earns.

2.) Banks also earn money from investment products.

To earn more money, bank invests the money they have. Banks has a big share from the profit they earn in investment products such as investments in stock market, government bonds, money market funds, mutual funds and other investment instruments.

3.) Banks earn money through administrative fees.

Some people invest their money to investment products offered by the banks. And some banks charge minimal administrative fees from the money of the people who invest. Example of investment products that banks charge administrative fees are investment insurance, mutual funds, money market funds, etc.

4.) Banks also earn through loss charges.

If you lost your passbook, ATM or credit card, banks charge you a fee. They said that the fee will be used to spend for the process of replacement and for the cost of the new material.

5.) They also earn money through service charge.

If banks are committed to secure your money, they also want the depositors to be committed in maintaining their required minimum balance. Banks have different service charges for different types of account. Through an automated accounting software, banks automatically charge a certain fee if the money of your account (let’s say savings account) reaches below the minimum balance requirement. So, the more people reach below the required minimum balance, the more money the bank earns.

6.) Banks earn money through entrance or application fees.

Some banks charge application fees to a person applying for a credit card or a loan. An application fee is charged to process home mortgage loan to cover for costs in property appraisals, credit checks, paper works, etc.

7.) Banks earn money through online banking fees.

We are now living in the age of internet technology (IT). Banks utilizes the power of IT in banking. That’s why banks nowadays offer online banking where you can access your account through a bank’s website anytime and anywhere. Some banks charge fees in transferring funds online. When you do online banking through your mobile phone, some banks charge activation fee, fund transfer fee, balance inquiry fee and reloading fee.

8.) Banks earn money the most and the biggest through commissions.

Like it or not, aside from the number of ways mentioned above, banks also earn money through commissions they get from certain investment products. Banks earn commission from a successful application of a person in investment insurance. Some banks give commissions to its branches who reach a specified quota in opening new accounts. In addition, banks sell companies. This is where they get huge commissions for companies they sell. An investment bank may sell companies for millions or even billions. If the bank sold out a company worth 10 billion dollars and given that the bank has 1% commission from that successful sale, the bank can earn a whooping 100 million dollars.

A bank is a special business institution that engages in buying and selling to earn money. Money is their main product. They buy and sell money in order to earn more money.

Like any other businesses, banks think, create and innovate for more ways on how to earn more money every day. They also have many other ways of earning money aside from those mentioned above. Do you know other ways how banks earn money? You can share them in the comment below. - https://www.affordablecebu.com/