Philippine Financial Markets

The local benchmark ended the week in the red with a four-day slide. PDST-F bid yields traded higher on the back of higher inflation. In the currency market, the Philippine peso depreciated against the US greenback

Local Equities

(Graph picture) Philippine Stock Exchange Index Graph which ranges from May 2010 to May 2011

The Philippine Stock Exchange ended the week with a four-day slump to close at 4,219.07, losing 100.44 points or 2.33%. The lack of positive leads, higher inflation, and missed earnings estimates, plus the break under the 4,250 support spelled the bearish mood for the local bourse. Value turnover was pegged at PhP26.04 billion

SMPH reported in its annual stockholders meeting that it is building new shopping malls in Cebu City’s reclaimed South Road Properties and in the industrial city of Tianjin in China. The Php4.5 billion mall in Cebu will have a gross floor area of 241,600 square meters, while the Tianjin mall will have 530,000 square meters and will open in 2013.

Lopez Holdings Corporation reported a net income of PhP13.17 billion last year, up 10.7 percent from PhP11.9 billion in 2009, on the record performance of ABS-CBN Broadcasting Corp. and gains from asset sales. Multimedia conglomerate ABS-CBN had a banner year in 2010, with net earnings surging 87 percent to PhP3.179 billion and revenues expanding 30 percent to PhP32.185 billion.

Philippine Bond Markets

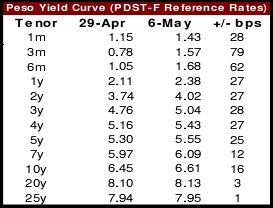

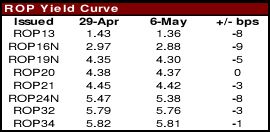

PDST-F bid yields traded higher across the curve to rise by an average of 27.99 bps on the news of the 4.5% April inflation. Notable movers were the three-month and six-month paper which increased by 79 bps and 62 bps, respectively.

Philippine Annual inflation jumped to 4.5% in April, following faster growth in all commodity groups including food, beverages, and tobacco, according to the National Statistics Office (NSO). The April inflation, which was within the monetary authorities' forecast of 3.7 to 4.7% for the month was faster than March's 4.3% but at par with last year's 4.5%. Consequently, the Bangko Sentral ng Pilipinas (BSP) hiked its benchmark interest rate for a second consecutive meeting to 4.5%. The BSP raised its key rate by 25 basis points last March 24, the first adjustment since July 2009, to temper rising inflation, bringing the overnight borrowing rate to 4.25%.

Reports from the Philippine Treasury department showed that state debt payments retracted 2.14% from Php339 billion during the first quarter of 2011 from the same period in 2010 as the decrease in interest payments tempered the increase in principal payments for domestic obligations. The government’s expenditures, which include debt servicing, totaled P349 billion in the first three months of the year, significantly less than the P431 billion ceiling mandated for that period.

Philippine Peso

The peso weakened 0.3 percent today to 43.080 per dollar, capping a 0.6 percent weekly loss.

The Bangko Sentral ng Pilipinas cautioned the government to temper the increase in minimum wages this year to around Php25/day (+6%); labor groups are demanding a wage increase of Php75-1 25/day (+19-24%). A minimum wage hike above P25 per day will increase pressure on consumer prices, BSP Governor Amando M. Tetangco, Jr. Rising fuel prices have prompted the Metro Manila wage board to move an adjustment to the metropolis’ minimum wage range of P367-404/day forward, with an announcement expected next week.

The week ahead (May 9 – May 13)

The Philippine Stock Exchange index is seen to recover this week after the four-day decline with buyers emerging to buy on dips. The local benchmark may be around 4,190– 4,290 points. Moving on, PDST-F bid yields are expected to go up to align with the policy rates, after the central bank raised interest rates for a second time this year. The Philippine peso, meanwhile, may continue its depreciation against the US dolar on the back of the weakness in the US economy. The currency pair may trade around PhP43.000 to PhP43.500

Source: www.bpi.com.ph - https://www.affordablecebu.com/