Fund Classification: Money Market

CLIENT SUITABILITY: Suitable for moderate investors who have short-term liquidity requirements and want to earn more than regular time deposits.

FUND OBJECTIVE: The Fund aims to achieve for its participants liquidity and income that is slightly higher than regular time deposits by investing in a diversified portfolio of short-term, peso-denominated fixed income securities and money market instruments.

FUND PERFORMANCE as of April 29, 2011

| Period | Fund | Benchmark |

| Past 1 month | 0.283% | 0.181% |

| Past 3 months | 0.804% | 0.503% |

| YTD | 1.017% | 0.650% |

| YOY | 2.921% | 2.066% |

| Past 3 Years | 11.355% | 7.487% |

FUND SUMMARY

- NAV - Php1.70 Billion

- NAVPU - 1.397991

- Wtd Ave YTM - 4.688% p.a.

- Wtd Ave Term - 0.20 years

- Wtd Ave Duration - 0.19 years

PRODUCT FEATURES

- Base Currency - Php

- Minimum Initial Participation - Php 50,000

- Minimum Additional Participation - Php 25,000

- Investment Horizon - One month

- Minimum Holding Period - 7 calendar days

- Early Redemption Charge - 50% of income earned form the redeemed amount

- Trust Fee - 1.0% p.a based on NAV

- Custodian Fee - 0.015% p.a.

- Applicable Tax - 20% Final Tax

- Valuation - Marked-to-Market

- Dealing Day - Daily up to 12:00nn

- Redemption Settlement - Next banking day from date of redemption

- Fund Manager - Metrobank-Trust Banking

- Custodian - Standard Chartered Bank

- Launch Date - April 4, 2005

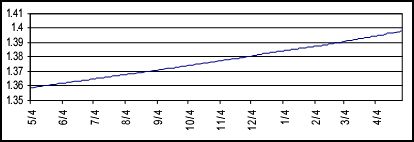

NAVPU TREND, Year-to-Date

TOP 10 HOLDINGS

| Security | Percentage (%) |

| TD – Other Bank | 14.50% |

| GENBSP SDA | 11.74% |

| GENBSP SDA | 5.87% |

| GENBSP SDA | 5.87% |

| GENBSP SDA | 4.12% |

| TD – Other Bank | 3.02% |

| GENBSP SDA | 3.00% |

| GENBSP SDA | 3.00% |

| TD – Other Bank | 2.99% |

| GENBSP SDA | 2.99% |

FUND COMPOSITION

Deposits = 100 percent (%)

OTHER DISCLOSURES

- Prospective investment outlets shall be limited to those described in the Declaration of Trust of the Fund.

FUND MANAGER'S REPORT

Peso Fixed Income

By Genevieve C. Pecaña

By Genevieve C. Pecaña

Prudent spending & aggressive implementation of programmed reforms on tax collection gained ground as major collection agencies of the government surpassed goals for the first quarter of the year. The Bureau of Internal Revenue (BIR), which accounts for 70% of total collections, brought in close to P200 Bn, exceeding its P197 Bn target. With a P13.4 Bn surplus posted in January 2011, 1st quarter deficit fell to P26.2 Bn, less than a fourth of the P112 Bn target. This puts the government on track in meeting its full-year target shortfall of P300 Bn or 3.2% of GDP, providing some leeway for spending in the second half of the year. With very impressive and encouraging fiscal data, the government confidently lobbied with the major international rating agencies for a rating upgrade. Initially, Moody’s, which raised its outlook to positive (from stable) in January 2011, indicated a strong chance for an upgrade earlier than scheduled.

Meantime, prices of oil escalated towards the end of April & almost hit a high of US$1 14/barrel due to the continued political unrest in the Middle East and the supply disruption in Africa. This took its toll on the Consumer Price Index which grew the fastest this month by 4.5% YoY (from 4.3% last month), higher than expectations of about 4.4%. Core inflation (which excludes food & energy prices) likewise rose to 3.8% (from 3.5%). Inflation was also higher at 0.8% MoM (from 0.3%) as FLW (Fuel, Light & Water) shot up by 6.4% (from 0.2%). For the first 4 months of the year, average inflation stands at 4.2% (from 3.8% in 2010), which is within the BSP’s target range of 3-5%. However, CPI may hit the high end of 5% in coming months as second round effects of price pressures from food, energy and wages (after the recent P22 COLA adjustment) are felt. To rein in higher inflation expectations, the Monetary Board raised overnight rates by another 25 bps for the second time in a row to 4.5% on May 5. Nonetheless, moving forward, we can expect weaker crude oil prices given renewed concerns on US growth & inventory levels. Meantime, political instability in MENA (Middle East & North Africa), while still a threat, appears to have dissipated.

The wave of positive news in April, coupled with market liquidity, encouraged investors to take in additional risk this month, prompting trading volume to pick up to an average of P14 Bn daily (from P7-8 Bn). T-Bill & T-Bond (7 & 10 years) auctions were also oversubscribed, indicating strong demand for government papers. Yields of domestic bonds trended lower for the second month in a row, declining by an average of 52 bps, led by the 2-year tenor (-108 bps), followed by the 5 to 10-year bonds (-80 to -85 bps).

OUTLOOK & STRATEGY

As expected, Special Deposit Account (SDA) rates followed the hike in policy rates by 25 bps, with the 30-day SDA now fetching a yield of 4.6875%. While some counterparty banks have instantaneously adjusted their deposit rates to attract funds, better-than-SDA yields were being offered for 60 to 90-day tenors. However, given our view that the BSP may still be expected to raise policy rates to combat inflation pressures, majority of fresh funds and maturities were redirected to the 30-day SDA facility, as we are reluctant in locking in at current deposit-rate levels, thereby allowing the fund to take advantage of opportunities in this monetary tightening scenario.

Participation in the Fund is NOT a bank deposit or an obligation of, or guaranteed, nor issued, nor insured by Metropolitan Bank & Trust Company (Metrobank) or its affiliates or subsidiaries and therefore are not insured or governed by the Philippine Deposit Insurance Corporation (PDIC). Any income and loss arising from market fluctuations and price volatility of the securities held by the fund, even if invested in government securities, is for the account of the investor. As such the fund is not capital protected and may not be suitable for clients seeking preservation of capital. Historical performance when presented is purely for reference purposes and not a guarantee of similar future results. The Declaration of Trust of the Fund is available at the principal office of the Trustee upon request.

Source: metrobank.com.ph

- https://www.affordablecebu.com/