Beyond the numbers, SM is now focusing its attention on the recent calamity that hit many parts of Luzon last week. It is one among many calamities that SM continues to learn from and prepare for given the changing weather patterns worldwide. SM also finds such events as a great opportunity to further extend its helping hand to the communities it serves.

SM President, Mr. Harley Sy said, "SM Foundation, our corporate social responsibility arm, doubled its relief operations this year, compared with the efforts done in previous calamities as we saw the larger scope of damage done by the recent monsoon surge. We will continue to help and assist our countrymen through medical missions and giving relief goods to the many areas affected by severe flooding."

For his part, Mr. Hans Sy, President of SM Prime Holdings, Inc. said, "When floodwaters rose in many parts of Luzon, we kept the malls open for flood victims to temporarily take refuge in SM malls. We opened our multi-level parking facilities to allow residents who live in low-lying areas to park their vehicles away from the flood. We are also now using our events hall at SM Megamall as a drop off point for those who wish to donate relief goods for the typhoon victims, which will be distributed accordingly by SM Foundation."

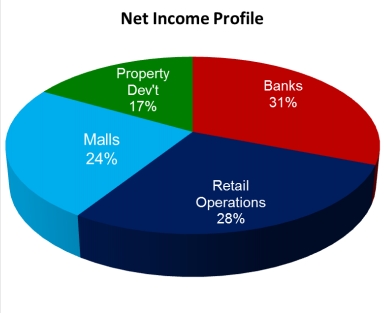

Net Income Profile

The banks continued to provide the largest contribution to SM's consolidated net income with a 30.9%, followed by a retail operations with 28.2%. Malls came in third with 24.2% followed by property development with 16.7%.

Retail Operations

SM Retail reported a 7.8% growth in net income worth PhP2.7 billion from sales growth of 8.3% to PhP73.8 billion. EBITDA was up 11% to Php4.9 billion for an EBITDA margin of 7% net margin was steady at 3.7%.

The group which consists of a chain of department stores and a separate chain of supermarkets and hypermarkets continued to expand its number of stores nationwide while getting a boost from improved consumer confidence. For the last twelve months, the number of stores increased by 35 of which 2 are department stores, 2 are SM Supermarket, 28 are SaveMore Stores and 7 are SM Hypermarkets. As of end June, SM Retail's total number of stores reached 183, consisting of 43 department stores, 34 SM Supermarkets, 73 SaveMore Stores and 33 SM Hypermarkets.

The group continues to expand all of its store formats with particular focus on the growth of SaveMore stores which has gained very strong market acceptance. This stand-alone store format which is patterned after a typical neigborhood grocery store offers greater convenience in communities where organized retail is lacking. SaveMore provides fresh food concepts, clean and attractive store layouts, and a highly diverse yet reliable mix of products and services.

Mall Operations

SM's mall operations, which is handled by listed subsidiary SM Prime Holdings, Inc., posted a 15% increase in net income of Php4.9 billion from Php4.3 billion during the same period of last year. Revenues, on the other hand, reached PhP14.6 billion, up 15% year-on-year. EBITDA for the period grew 12% to PhP9.71 billion for an EBITDA margin of 67%. Better growth resulted from the improved performance of the existing malls both in the Philippines and China with same store sales growing by 8%, boosted further by the opening of new malls in 2010 and 2011.

The four malls in China posted a hefty 30% growth in revenues to PhP1.3 billion and contributed 9% to consolidated revenues. In terms of net income, SM China showed a growth of 52% to PhP321 million, for a net margin of 25% and 7% contribution to SM Prime's consolidated net income. The average occupancy rate for the four malls in China is now at 95%.

After opening SM City General Santos in South Cotabato last week, SM Prime now has 45 malls strategically located in the Philippines with a total gross floor area of 5.5 million square meters. In China, SM Prime's malls are located in the cities of Xiamen, Jinjiang, Chengdu and Suzhou with a total gross floor area of over 600,000 square meters. Earlier this year, SM Prime opened SM City Olongapo in Zambales, SM City Consolacion in Cebu and SM City San Fernando in Pampanga. For the rest of 2012, SM Prime is scheduled to open SM City Lanang in Davao City, and SM Chongqing in China.

Banks

BDO Unibank, Inc. (BDO) reported a 15% increase in its first half of 2012 unaudited net income of PhP5.83 billion from PhP5.05 billion posted in the first half of 2011. Net interest income increased by 2% to PhP17.4 billion on robust loan growth and the continued hike in low-cost deposits. Gross customer loans grew 18% to PhP719 billion with growth coming from all segments. Fee-based service income rose to PhP6.8 billion, while Trading and Foreign Exchange Gains was at PhP2.5 billion in provisions were booked for the interim period even as asset quality improved with BDO's nonperforming loan (NPL) ratio declining to 3.1% from 3.5% in the previous quarter. NPL coverage rose to 119% from 110%.

BDO expressed optimism about the country's prospects and opportunities in the banking sector. Last July 4, 2012, it executed a landmark deal raising PhP43.5 billion (equivalent to over US$1 billion) in core capital from a 1 to 3 rights offer to support its medium-term growth objectives and meet the Basel III capital requirements ahead of schedule. Part of the proceeds from the additional capital will be utilized by the Bank to exercise its early redemption option on PhP10 billion of higher-cost Tier 2 debt in November 2012.

Property Development

SM Land reported first-half 2012 revenues worth PhP13.9 billion, up sharply by 59%. Net income for the same period grew 37% to PhP3.2 billion for a net margin of 23%. EBITDA rose 33% to PhP3.9 billioin, for an EBITDA margin of 28%. Most of SM Land's revenues and net income are derived from its residential arm, SM Development Corporation (SMDC).

SMDC continued to surprise the market as its first-half home sales surged by 85% to PhP19.8 billion. Correspondingly, the number of units sold rose sharply by 72% to 8,007 from only 4,655 units during same period last year. Financial performance for the period remained very strong as revenues from real estate rose 73.6% to PhP11.9 billion. Net income from real estate grew 31.8% to PhP2.51 billion while consolidated net income increased by 38% to PhP2.7 billion for a net margin of 22%. EBITDA also rose by 32.6% to almost PhP3.0 billion translating to an EBITDA margin of 25%.

SM Balance Sheet

The total assets of SM Investments expanded by 28% to PhP518.4 billion driven by growth in equity and fresh funds through borrowing, primarily from a 5-year US$250 million convertible bond (CB) issued earlier this year, with a coupon rate of 1.625T%, a yield to maturity of 2.875% per annum. As of end June 2012, SM maintained a conservative ratio 39% net debt to 61% equity.

For further information, please contact:

Ms. Corazon P. Guidote

Senioir Vice President for Investor Relations

SM Investments Corporation

Email: cora.guidote@sminvestments.com

Telephone number: 857-0117

- https://www.affordablecebu.com/