Did they get rich of being an OFW?.... absolutely NO. Some of them went back to zero and suffered debt problems.

The others established their own businesses but earned just enough money for the family to survive. Only very few were able to increase their income and bought several properties.

And I think that most OFWs experience the same. Why?

They are trap to poor money habits and attitudes. Let's take a look at these habits and attitudes in details.

High Pride

Thinking too highly of yourself that you earn big abroad can harm your financial well being. That you are an OFW, a bigtime in the eyes of your friends and family, you are prone to spend your money extravagantly. I see most of these OFWs in my Facebook page.

Instead of putting first your money to valuable investments, you buy things you don't really need. You buy expensive and branded shoes, dresses, gadgets, appliances, vehicles and other things that you can postpone to buy. These things depreciate in value.

You also tend to spend your hard-earned money to several vacations. You go to different places and treat your friends. And you don't mind your money anymore. You don't think how much money you've wasted anymore.

You might say, "It's my money. I have the right to spend it the way I want and enjoy from it."

Yes, you have the right to do anything with your money. You have the right to enjoy from the fruit of your labor. But it's not right to spend too much of it from worthless things and things that you can postpone to buy or to do.

I know several of my OFW friends who did those worthless things and regret it later. They went back to zero. They didn't realize that time is running fast. Years gone so fast.

Everytime you went home, it's better not to buy those things you don't really need. It's better to maintain your low-profile than exposing your flaming pride that can burn your financial well being to ashes in the future.

No Exact or Definite Plans

A plan is like a map. Why?

Imagine this. You're a traveler. You're planning to go to an unfamiliar place. You don't have a map. Can you arrive at your destination? Of course not. Unless if you have someone who already knew the place.

The place I've mentioned is the goal. The map is the plan. Without definite plans, you cannot reach your goals.

You are an OFW. You plan to go abroad to earn big and help your family. Are these your only plans? You might be mistaken.

Do you also plan to be financially free and get rich? "Of course, yes". Who doesn't want to get rich?

Then you must have detailed or definite plans. Let me help you layout those plans that can increase your income.

Assess and Increase your current income

How much do you earn from your job? P50,00? P100,000? P200,000?Always think of your current income. Do you want to increase that income? Then, you must do something about it.

Don't waste your time and don't be contended of your current income.

Remember: your current income is equivalent to the value that you offer to the current market. Low-paying job means that you're offering less value to the company that you work for.

Want to give more value to your company? Don't be contended of your low-paying job. Upgrade your career. How?

Learn more. Study more. Equip yourself with more valuable skills.

Sad to say, Filipinos have this "lazy" attitude. Lazy. Lazy. Lazy.

"I can't do that. I'm too old to learn new skills/ideas. I will do that in the future." Their inner being is always projecting this bad attitude. Years gone by so fast and if you will not learn more, you will receive the same low income.

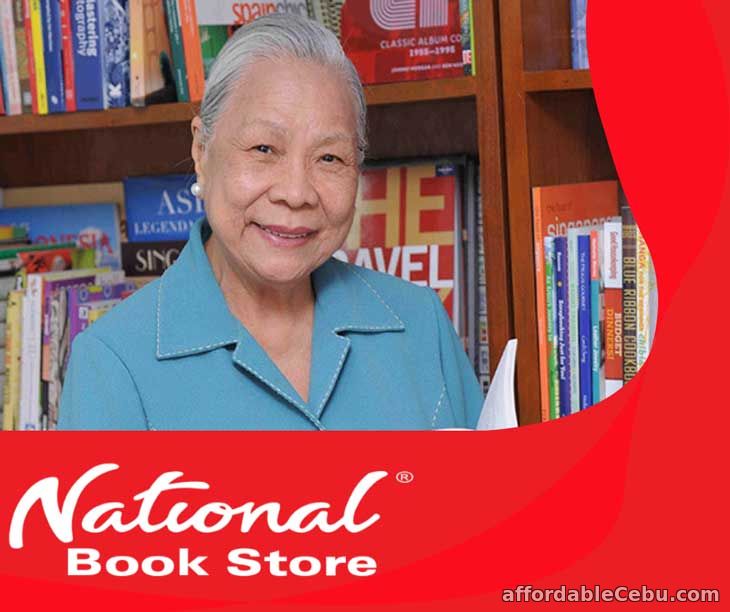

Former saleslady who became the National Book Store founder, Socorro Ramos said, "Work hard, you know if you have the love and passion to what you do, hard work is no longer a sacrifice but a joy". "Invest in your mind. Read more. Know more. Earn more".

Socorro Ramos - National Bookstore founder

Exit Plans

How many years are you going to work abroad? Lifetime?It's so sad to leave your family and work abroad. You will miss them for many months or even years. Loneliness.

But what's more sad is if you go back home and went back to zero because you didn't have exit plans.

Exit plans may include:

Business ventures. Business needs capital and knowledge. What's more important is knowledge or skills. While working abroad, you should study one specific business you find enjoyable.

Everyday after work, don't forget to research that business, develop your ideas and learn the skills to operate that business. Think of that business as your child, feed it and develop it. And always equip it with innovation because we live in a competitive world.

Sideline Source Income. While working abroad, learn new skills that will become a new source of income in the future. Aside from engaging in network marketing business, learn valuable and high in demand skills today:

- software development

- graphic designing

- web development

- blogging

The food industry is also booming. Look at Jollibee, Mang Inasal, and the Food Cart Business. They're growing. Mang Inasal founder Edgar Sia II invented the recipe of a tasty grilled chicken with unlimited rice.

When Jollibee bought a big stake of Mang Inasal, Sia became the youngest richest man in the Philippines at his 30's.

In 2011, Mang Inasal has grown to over 400 stores in the Philippines overtaking McDonalds.

Learn cooking skills that may lead you to start a restaurant business after working abroad.

Learn any skills you love that can increase your income. For more information about increasing your income to get rich, you can read my other article "Money Cannot Make You Rich".

No Investment Strategy

Without investment strategy, you will miss this big opportunity in the future - the opportunity to retire and be financially free.

I know it's hard for low-paid OFWs to save and invest their money. But with hardwork, discipline and focus, you can do wonderful miracles in your income. Follow my advices above to increase your income. Always look in the future. Plan it. Own your fortune. Have an investment strategy.

For high-paid OFWs, avoid spending your money to a lavish lifestyle. Instead, invest it to real estate: developing apartments, boarding houses, townhouses or commercial establishments.

I know a high-ranking official seaman OFW. He and his wife are both humble and kind. His wife is a stay-at-home and has no job. But she knows how to manage their money well.

This seaman is regularly remitting money to his wife. His wife, on the other hand, used their money to buy properties and build apartments and houses. They now have 7 apartments and 3 houses in different locations. Those 7 apartments are now fully-rented. While those 2 houses are built not for personal use but for sale. They bought those land where they built the houses at very cheap prices. And now they are selling it at a price that triples their investment. And I'm one of their customer who bought one of their houses.

Inspiring, isn't it? Let's read more OFW stories that can help turn your money habits from poor to good or even excellent.

OFW Inspiring Stories

OFWs are regarded as "Modern Day Heroes". If you're an OFW, you already know the reason behind that quote.

And there are good examples of OFWs who live with that quote.

Former OFW Myrna Padilla left high school one year short of earning her diploma. She became a domestic helper for 20 years in Hong Kong, Singapore, and Taiwan.

She felt driven to help stop the exploitation of Overseas Filipino Workers, and established the Mindanao Hong Kong Worker’s Federation in 1999.

Yet she never gave up her dream of changing her life. She returned to the Philippines to be with her family. When her Chinese employer’s eight-year-old son taught her how to use email, she realized she could use technology as a means to earn money.

Empowered by technology, she connected with her family in the Philippines through the Internet. But she didn’t stop there. With everything she knew about the Internet, Padilla put up her first BPO firm Mynd Tech in 2006, which has now evolved into Davao-based Mynd Consulting.

Robinsons Mall and Cebu Pacific owner John Gokongwei Jr. emphasized, "I discover that opportunities don't find you. You find your opportunities."