About the Company

Trans-Asia Oil and Energy Development Corporation is an end-to-end energy company engaged in oil and gas exploration and development, power generation, and electricity supply.

The Company holds minority investments in various consortia engaged in petroleum exploration, development and production. Trans-Asia owns as well as operates various power generation facilities and sells electricity through bilate contracts and through the Wholesale Electricity Spot Market (WESM).

Project Updates

Power Supply Contract with Lafarge

Trans-Asia signed a long-term contract on July 9, 2012 to supply part of the electricity requirements of Lafarge Republic, Inc. over the next five years commencing on December 26, 2012.

TAREC Wind Project

With the issuance of the Feed-in-Tariff (FIT) for renewable energy (RE) on July 27, the Company is looking to push through with its Php6.3 billion 54MW Guimaras wind farm project. Construction is expected to commence within the year. Under the RE Law, all qualified renewable energy generators are ensured priority dispatch and payment via the FIT scheme for a period of 20 years.

CIP II Power Plant

Commissioning of the 21MW BFO power plant in La Union is ongoing and commercial operations will commence as soon as the connection to the NGCP is completed.

Maibarara Geothermal Project

The year 2012 marks the full-blast development of the Maibarara steam field and power plant facility. Steamfield design and site preparation have been completed. Construction contracts for the steam gathering system have been awarded or tendered. As of 19 July 2012, power plant construction is about 35% completed. Drilling of 1 production well is nearing completion and the drilling of 1 injection well and workover of 1 existing production well will follow.

Maibarara Geothermal Inc. expects to commission a 20MW geothermal power plant by the third quarter of 2013.

SLTEC Power Plant

Pile fabrication, earthworks and pile driving works in line with the foundation design requirements are ongoing and on track. Construction of facilities to house on-site engineering teams of DMCI, CNTIC, and SLTEC has been completed. The 135MW CFB plant is expected to start commercial operations by the fourth quarter of 2014.

Oil & Gas Portfolio

Latest updates and status the of Company’s drilling and exploration acti include:

- SC 52(Cagayan, gas): Re-entry and testing operations for two well in Nassiping were completed in Feb 2012. Re-test is planned for 4Q 2012.

- SC51 (East Visayas, oil): 100-km 2D seismic acquisition program in northwest Leyte is on-going. Drilling of 1 onshore well is scheduled in 2013

- SC55 (West Palawan, gas): Drilling is scheduled in 1Q/2Q 2013.

Stock Information

As of June 29, 2012:

- Ticker code: TA

- Market Capitalization (PhPm): 3,453

- 12-week high (PhP): 1.29

- 12-week low (PhP): 1.18

- Shares issued (m): 2,830

Major shareholders:

- PHNMA Group: 54.8%

- Emar Corporation: 2.5%

- Directors and Officers: 0.9%

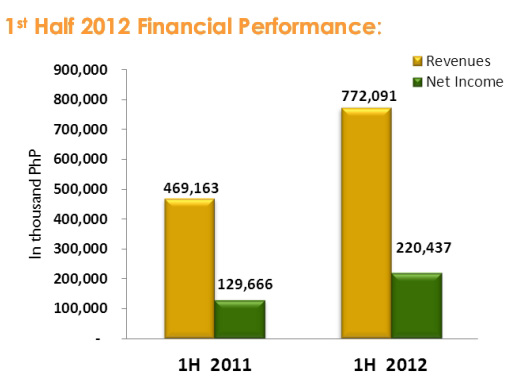

1st Half 2012 Financial Performance

Consolidated revenues almost doubled to P525.59 million in the second quarter of 2012 from P289.25 million in the same period last year due to higher power rates and higher energy sales.

For t he first semester of 2012, consolidated revenues rose to P772.09 million from P469.16 million for the same period last year .

Trans-Asia posted a net income of P220.44 million in the first semes ter of 2012 as compared to P129.67 million in the same perio last year .

Tight power supply conditions and stronger demand, given higher outage levels of large generating plants in Luzon during peak periods pushed up the spot market price of electricity in the Luzon Grid.

Trans-Asia’s own generation supply portfolio and contracted capacities protected the Company from the resulting higher WESM prices and at the same time provided opportunities to sell excess capacities at the spot market during peak periods . Trans-Asia’s contract customers c omprised the bulk of total energy sales.

Current Ratio

Current ratio declined to 3.79:1 as of June 30, 2012 from 4.44:1 as of December 31, 2011 brought about by equity call requirements from its investments in SLTEC Unit 1 and Maibarara Unit 1, as well as payment of cash dividend in the first semester of 2012.

Return on Equity

The rate of return on s to ckholders’ equity went up to 4.77% in the first semester of 2012 from 3. 54% in the same period last year as a result of higher net income in the first semester of 2012 , despite the incr ease in capital stock.

Earnings per Share

Earnings per share was maintained at P0.08 in the first semester of 2012 and 2011 .